Revolut Debit Card Review

Revolut is a Fintech company with its own mobile application that allows it to operate as if it were a bank. Registering is very simple, it takes only 60 seconds, and you can have accounts in different currencies, which, in some cases, is very interesting. In addition, Revolut also functions as a Bitcoin debit card provider.

Revolut Review Contents

- About the Company

- Supported Countries

- Unavailable Countries

- Social Media

- Services Provided

- Fees, limits and pricing

- Revolut user experience

- Pro´s and Con´s

- Review Conclusion

About Revolut

With a mission to build the world’s first truly global financial superapp, Revolut was founded in 2015 in the UK by Nikolái Storonski y Vlad Yatsenko, offering money transfers and an exchange has become a digital bank with over 12 million personal customers and over 400,000 business customers, it offers services in 35 countries in over 30 in-app currencies. Revolut aims to offer stress-free worldwide spending, free international spending and transfers, and access to cryptocurrency exchanges.

It is the fastest-growing digital bank with the widest array of features. A top choice for those who travel frequently. However, in the UK it might not be able to fully replace your bank.

Revolut Address

Revolut is based in London, England, according to their website, their registered address is 7 Westferry Circus, Canary Wharf, London, England, E14 4HD.

Revolut supported countries

Revolut is currently available in all the European Economic Area (EEA), Australia, Switzerland, and it even started offering its service to its North American clients in the United States. It should be noted that Revolut has only been working in the US since March 2020.

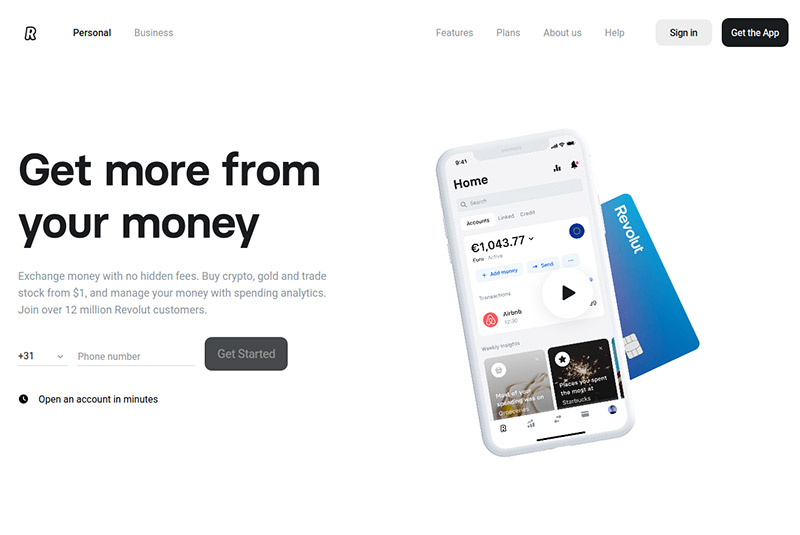

Revolut aims to allow its user base to “get more from their money” by offering to exchange money with no hidden fees, buy crypto, gold, and trade stocks from 1 USD and manage their money with their spending analytics. They want to allow people to manage all their finances in one place.

Revolut has all of its detailed information on the bottom of their website so it is transparent in this regard, which is great since most scams don’t offer this kind of information. However, no customer support email can be found anywhere on their website.

Unavailable countries

Revolut is not currently available in more than 30 countries, so their services will not be available for all their residents. These countries are:

- Tuvalu

- North Korea

- São Tomé and Príncipe

- Eritrea

- Iran

- Crimea

- Eastern Ukraine

- Transnistria

- South Ossetia

- Afghanistan

- Dutch Antilles

- Aruba

- Burundi

- Bhutan

- Congo / Kinshasa

- Djibouti

- Gambia

- Guyana

- Comoros

- Liberia

- Lesotho

- Libya

- Mauritania

- Sudan

- South Sudan

- Sierra Leone

- Somalia

- Somaliland

- Syria

- Swaziland

- Tajikistan

- Uzbekistan

- Yemen

Revolut on Social Media

- Facebook: https://www.facebook.com/revolutapp

- Instagram: https://www.instagram.com/revolutapp/

- Dribble: https://dribbble.com/revolut

- Twitter: https://twitter.com/RevolutApp

- LinkedIn: https://uk.linkedin.com/company/revolut

Services Provided

Revolut offers banking services to its user base through a mobile app, getting an account is fairly easy since you only need to install the app and register, it requires no proof of address and no credit checks, but there is a KYC process in which you will need to take a picture with a valid identification document.

Since it offers banking services you can do everything you can do with a normal bank account, which includes sending money to other people and withdrawing cash from an ATM, however, it also offers other great services, such as free international money transfers, fee-free global spending, and access to a cryptocurrency exchange. Revolut also offers a card, it’s not a debit card but a prepaid card, which works similarly to a debit card as long as it has funds, however, it does have its limits, which we will talk about in a bit.

Their prepaid card is a Mastercard, which means it can be used anywhere Mastercard is accepted, which is in over 40 million places all over the world. The card can use 3 currencies at the same time, USD, EUR, and GBP, you can load and unload the card using the revolut app, and transfer it to other Revolut users. All ATM withdrawals worldwide are free.

Here you can see all the services they offer in a more detailed manner depending on which plan you choose.

Currencies in the app

There are 35 currencies you can use to exchange money within the app: AED, AUD, BGN, CAD, CHF, CZK, DKK, EUR, GBP, HKD, HRK, HUF, IDR, ILS, INR, ISK, JPY, MAD, MXN, MYR, NOK, NZD, PHP, PLN, QAR, RON, RSD, RUB, SAR, SEK, SGD, THB, TRY, USD, ZAR.

Top-up currencies

You can top up your Revolut account in 15 currencies: AUD, CAD, CHF, CZK, DKK, EUR, GBP, HKD, JPY, NOK, PLN, RON, SEK, USD, ZAR.

Fees, Limits, and Pricing

On the image we showed earlier you can see the pricing for each plan they offer, the Standard is free, the Premium costs 6.99 GBP (9.99 USD) a month or 72 GBP (94.99 USD) a year and the Metal costs 12.99 GBP (16.99 USD) a month or 120 GBP (149.99 USD) a year. Now let’s go into the limits and fees for each plan they offer.

In the free plan, it costs €5.99/£4.99 to get your first physical card delivered. This is included free in the Premium account.

- Standard: it’s free to add money to the card, but depending on where you are from and where your account is, and where you add money from a fee may be applied, for example, let’s say you are from the UK, all top-ups are free as long as you add them from an EEA issued card, if not then a fee may be charged. To get the card is free, but the delivery is covered by the customer. ATM withdrawals are free up to 200 GBP per rolling month; everything above this will have a 2% fee applied. For more details, you can head over to this link https://www.revolut.com/legal/fees.

- Premium: Same as the Standard, it’s free to add money to the card, but depending on where you are from and where your account is and where you add money from a fee may be applied, for example, let’s say you are from the UK, all top-ups are free as long as you add them from an EEA issued card, if not then a fee may be charged. . To get the card is free, but the delivery is covered by the customer. ATM withdrawals are free up to 400 GBP per rolling month; everything above this will have a 2% fee applied. For more details, you can head over to this link https://www.revolut.com/legal/premium-fees.

- Metal: Same as the other two, it’s free to add money on the card, but fees may be applied depending on your account and where you are sending money from. Customers only have to cover the shipping fee. ATM Withdrawals up to £800 or currency equivalent per rolling month are free. Anything over the above limits is charged at 2% of the value of ATM Withdrawal. With the Metal plan customers also get Metal cashback and the maximum cashback you can receive in a one-month billing cycle is 12.99 GBP. For more details, you can head over to this link https://www.revolut.com/legal/metal-fees.

Does Revolut have a premium on the bitcoin price/a bad exchange fee?

Although Revolut does not state whether they have a premium on the bitcoin price or even a bad exchange fee (no company would say that they have a bad exchange fee if they want to attract customers), users have stated that they have found hidden fees when buying bitcoin and exchanging bitcoin to fiat currencies like Euro, however in the Revolut community forums other users and the Revolut team state that the information regarding these fees is available on their website and as always, people should do their necessary research before becoming a platform’s users, even more so with banking and crypto financial platforms.

Are the funds held in bitcoin or converted immediately?

The funds are not only held in bitcoin, in case you sell bitcoin for fiat currencies such as Euro, Revolut will deposit said amount of fiat in your Revolut account, this fiat is the one that you can use to make purchases, you cannot spend crypto to buy things, you must exchange crypto to fiat first, which will be exchanged according to their rate at the moment of sale and then you will be able to use the fiat in your balance for making payments.

Revolut has something they call Auto-exchange, which is pretty much exchanging with the tap of a button on their app, you can instantly exchange 24 fiat currencies and 5 cryptocurrencies instantly with one click through the Revolut app.

Shipping details

Revolut has both standard shipping and express shipping, both with different pricing and delivery time depending on the country where the card is being sent to. The standard delivery fee is 5.50 EUR and the express delivery fee is 19.99 EUR.

Card shipping information is not available on their main website, but you can easily find this information if you head over to their FAQ section, this section has a very handy search bar function where you can simply type your desired question, according to their FAQ section the Revolut cards are normally dispatched the next working day after you place the order, the delivery can take up to nice working days for standard shipping, there is also express delivery service available, for Japan, UK, US, and Canada this express delivery will take three days and for other countries, it will take four days. It is worth noting that these are estimated delivery times and that they can’t guarantee a specific delivery date but you can always check the estimated time of arrival under the “Card” section of the Revolut app.

2FA and Revolut App

Revolut does offer 2-factor authentication (2FA), however, this 2-factor authentication is only available for businesses and not for personal accounts, they talk a lot about their security on their website, regarding their 2-factor authentication they use both email and SMS verifications to protect your account during crucial operations. The quality of Revolut’s business account was tested in this review.

The Revolut app is available for both iOS and Android Smartphones.

Revolut User Experience

The Revolut website has a very clean design with a gray and white theme, it is well structured and most information is only a few clicks away, they display all their legal information and details on the bottom of their website so they are transparent in this regard, it’s not a hard website to navigate and even people with little financial knowledge can navigate the website and understand the services that they offer.

Scam reports and user complaints

There haven’t been any scam reports regarding Revolut as of now.

Revolut has very mixed reviews online, even though there are no scam reports there are more negative reviews than positive reviews which is a very unsettling fact for a banking company, however, before using any kind of service, even more so with financial services, it’s very important to do your own research before making your decision.

Customer service

You can find lots of information right over at their FAQ section, which is already very complete and also has a search bar function, however, if there is anything you cannot find on their FAQ section you can always contact Revolut customer service via live chat through their app, calling them on their 24/7 customer service line or even contacting them through their various social media, such as Facebook, Instagram, Twitter, LinkedIn and Dribble, Revolut also has a community forum where you can also post your questions for other users and the Revolut team to answer.

Pros

- Easy to set up and no credit checks

- 24-hour customer service

- Free money transfers at interbank exchange rates

- Cards can be used anywhere where Mastercard is accepted

- Lower exchange rate

- ATM withdrawals are free as long as you don’t go above their limit

Cons

- Online only, it has no branches

- On the weekends foreign currency transactions have a markup of 0.5%

- Low limits, free cash withdrawals have a 200 GBP limit

- Missing features for US citizens

- Users must provide a proof of where their funds come from (as a part of their anti-money laundering procedures)

Overall Conclusion

Revolut offers an app and prepaid card, and it’s aiming to allow users to manage all their finances from one place (their app). It’s even available for US citizens, which is a huge plus since lots of services are not available for American citizens, however, not all services and benefits are available for them but being able to use it as a US citizen is a big plus. The card is not quite a debit card, it’s a prepaid card, and it will work as long as it has balance, they offer 3 different plans with different prices, the pricier the plan the more benefits, however, the limits are low compared to other companies, and after you go above the limits fees will be applied. There haven’t been any scam reports about Revolut, but complaints about it have surfaced on the internet and mainly because of the fees.

Please share your experiences!

If you have any experience with this Bitcoin Debit Card Provider – please let the community know in the comments below and rate the provider. Thanks! Karma++

Go to revolut.com